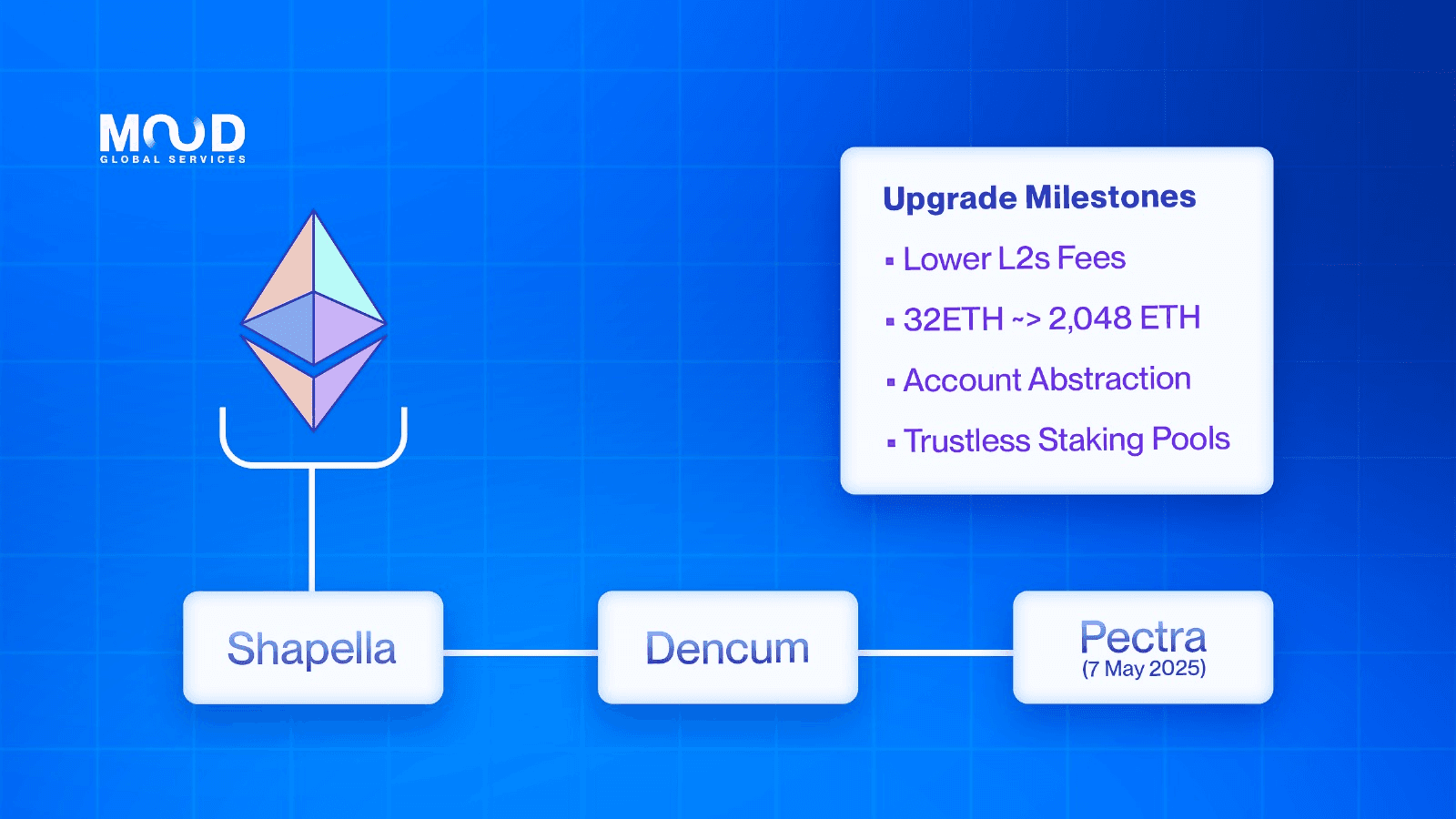

Today’s Ethereum developers are gearing up for the next major network upgrade, Pectra, scheduled to hit mainnet in early May 2025. Pectra is a combined hard fork (Prague on the execution layer + Electra on the consensus layer) and marks the first big update since the Dencun fork in March 2024. It’s one of the most ambitious upgrades yet with multiple EIPs (Ethereum Improvement Proposals) targeting improvements in validator flexibility, network scalability, user experience, and execution efficiency. This post dives into the key EIPs in Pectra – what they do, why they matter, and the problems they solve – to help Ethereum developers and technically-minded users understand the coming changes.

Key proposals in Pectra include raising the staking limits for validators, introducing a form of account abstraction for wallets, dynamically scaling “blob” data throughput, optimizing how validator deposits and withdrawals are handled, and more. Below we break down each major EIP in the Pectra upgrade and how it improves Ethereum’s efficiency, scalability, security, and usability.

EIP-7251

EIP-7251EIP-7251: Increasing the Maximum Validator Balance (32 → 2048 ETH)

One headline change in Pectra is EIP-7251, which raises the maximum effective staking balance per validator from 32 ETH to 2,048 ETH. Currently, any stake above 32 ETH per validator is not utilized for earning rewards – large stakers must split their ETH into many 32 ETH validator instances. EIP-7251 allows opting in to a higher cap so that a single validator can actively stake and earn rewards on up to 2048 ETH. (The minimum to activate a validator remains 32 ETH)

How it works: Validators who wish to use the higher limit will update their withdrawal credentials to a new format (prefix 0x02) recognized by the protocol. Once opted in, the protocol will no longer “sweep” balances above 32 ETH out as forced withdrawals; instead, balances can grow (via earned rewards) up to 2048 ETH before excess is swept. This effectively enables automatic reward compounding – validators can reinvest staking rewards back into their validator balance continuously up to the new cap.

To account for the larger stake at risk, the slashing rules are adjusted: if a large-balance validator misbehaves, the initial slashing penalty is reduced to 1/4096 of its balance (versus the current 1/32).

This way, a 2048 ETH validator isn’t immediately slashed dozens of ETH in one go – penalties scale more gently with the bigger stake. Finally, EIP-7251 modifies how validator exits are regulated to avoid sudden outflows: instead of allowing a fixed number of validators to exit per epoch, the consensus layer will cap the total ETH that can leave per epoch (max 256 ETH per epoch, ~57.6k ETH/day). In practice this means a single large validator’s exit would be rate-limited if necessary, preventing excessive withdrawal of staked ETH in one epoch.

Why it matters:Scalability and efficiency of staking. This change addresses the growing strain of having hundreds of thousands of 32-ETH validators on the network. By allowing consolidation of stakes, large operators can run fewer validator instances and beacon nodes, easing networking and operational overhead. In fact, EIP-7251 is expected to reduce the total number of validators (at least temporarily) as big stakers merge many small validators into one. Fewer validators means a lighter load on the consensus network – less chatter from attestations – which improves consensus efficiency and helps Ethereum scale its validator set more gracefully. Galaxy Research analysts note that with Ethereum potentially heading toward millions of validators, this consolidation will relieve networking pressure on the protocol.

At the same time, smaller stakers benefit as well: they’ll be able to compound earnings instead of having every 32+ ETH skimmed off, and they can stake odd amounts above 32 (e.g. 40 ETH) without needing to spin up a second validator. Overall, raising the cap makes staking more flexible and user-friendly. It does introduce centralization considerations – a single validator can now hold much more stake – but the protocol safeguards (like adaptive slashing penalties) aim to balance safety. By smoothing out validator count growth and enabling reward compounding, EIP-7251 improves the scalability and economic efficiency of Ethereum’s proof-of-stake.

Pectra upgrade props

Pectra upgrade propsEIP-7002: Smart Contract–Controlled Validator Withdrawals

Another major Pectra upgrade for stakers is EIP-7002, which allows validator exits and withdrawals to be triggered from the execution layer (EL) – i.e. via normal Ethereum transactions – rather than only via the consensus layer. In today’s Ethereum, if a validator wants to exit (stop validating and unlock stake) or withdraw accumulated rewards, that action must be initiated by the validator’s own key on the consensus layer. This is inconvenient and can be risky – the validator signing key (which is used to perform duties and signal exits) is a “hot” key that might be managed by a staking provider or otherwise not readily accessible to the ETH owner. EIP-7002 fixes this by letting the withdrawal credential (typically an Ethereum address) initiate exits/withdrawals.

How it works: Under this proposal, validators with the standard 0x01 withdrawal credentials (an Ethereum address) can submit an exit or withdrawal request via an Ethereum transaction from that address. In practice, the execution layer will have new transaction types or methods to register these requests. When such a transaction is included in an EL block, the consensus layer will see it and process it: for exits, the validator is added to the exit queue (just as if they had signaled exit themselves). For withdrawals of already-exited validators, the request goes into a new “manual withdrawal” queue on the EL, which will allow up to 8 withdrawals per block to be processed. Importantly, this mechanism is additive – it doesn’t remove the existing ability for a validator (using their consensus key) to trigger an exit or withdrawal; it just provides an alternative route through the execution layer.

Why it matters:Security and flexibility. Previously, only the validator’s own key could trigger a withdrawal, which meant if you delegated your stake to a service or pooled it, you had to trust the operator’s cooperation to exit. With EIP-7002, validators can be exited “externally” by the address that owns the withdrawal rights (which could be the staker’s cold wallet or a smart contract). This reduces trust and improves safety – for example, a staking pool’s smart contract (as the withdrawal credential) can autonomously initiate exits for validators when users request withdrawals, enforcing the process on-chain. It also mitigates a key risk: validator keys are typically kept online and could be compromised, whereas withdrawal credential keys can be kept offline (or tied to smart contract logic). By allowing the withdrawal key to be used for critical operations, Ethereum removes the “single point of failure” of the hot validator key. As Coinbase’s engineers explain, this change means no more absolute reliance on potentially vulnerable active keys, making the staking model more secure and trustless.

From a usability standpoint, stakers gain more direct control. Whether you’re a solo validator or part of a DAO-managed validator, you can now trustlessly exit using your withdrawal address without needing the validator operator to intervene. This is a big win for decentralization of control. In summary, EIP-7002 gives Ethereum validators a safer and more flexible way to manage their exits and withdrawals, improving the overall security and user-friendliness of staking.

EIP-6110: On-Chain Validation of Deposits (Faster Validator Onboarding)

EIP-6110 targets the front end of the validator lifecycle – deposits. It redesigns how new validator deposits are processed by making the process happen on-chain and in real-time, rather than relying on the current delayed voting mechanism. In the existing setup, when you deposit 32 ETH into the deposit contract to become a validator, Ethereum’s consensus layer has to observe that deposit via a special voting logic (the eth1data votes) and only after finality include it, which introduces significant delays (often many hours) before a validator actually gets activated. EIP-6110 streamlines this.

What it does: Validator deposit data will be directly included in execution layer blocks as a list of deposit operations. In other words, when a deposit transaction is mined on the EL, that block itself carries the info to the consensus layer, without waiting for separate CL votes. The consensus nodes no longer need to poll an external JSON-RPC or wait for a majority to “vote” on deposit contract logs – instead, they trust the deposits included in blocks (with the EL ensuring the deposit contract logic was executed correctly). This change eliminates the need for the old deposit voting scheme and hands the responsibility of deposit inclusion/validation to the EL itself. The CL will still verify a summary (a deposit root) for security, but it no longer has to worry about inconsistent node views or malicious proposals of fake deposits. The result is that a deposit becomes effective much faster: an honest node can’t be tricked into processing a bogus deposit (improving security), and the wait time from deposit to CL processing drops from ~9-12 hours to on the order of minutes.

Why it matters:Speed, simplicity, and security. New validators will be able to join the network much faster – roughly within a few epochs (~minutes) instead of half a day – because the deposit is recognized as soon as it’s in a finalized block. This is a huge usability improvement for staking, making the onboarding experience more seamless. From a protocol perspective, this also reduces complexity and points of failure. The old deposit flow relied on aligning the execution chain’s state with the beacon chain via off-chain polling and voting, which introduced potential failure modes (inconsistent JSON-RPC data, deposit contract snapshot issues. EIP-6110 removes those kludges: the design is cleaner with deposits handled in-protocol on the EL, and there’s no chance of a malicious majority censoring or faking deposits because an honest block proposer will include the real deposit and everyone will accept it. In short, Ethereum’s deposit processing becomes more secure (no more complex voting that could be subverted by >2/3 malicious stake) and more efficient. For node operators, it’s one less thing to worry about (no need to maintain deposit contract mirrors or custom RPC calls). For stakers, it means getting from deposit to validating in maybe ~13 minutes instead of ~9+ hours, enhancing the responsiveness of Ethereum’s proof-of-stake system.

EIP-7702: Introduction of Account Abstraction (Smart-Account Transactions)

Perhaps the most anticipated feature of Pectra for application developers and users is EIP-7702, which is frequently described as a big step toward account abstraction on Ethereum. In simple terms, EIP-7702 will allow your normal externally-owned wallet address (EOA) to temporarily behave like a smart contract – gaining superpowers like batching multiple actions or having custom verification logic – within a single transaction. It does this without actually converting your account into a contract permanently. Ethereum insiders have hailed this EIP as a “massive UX-enabler” and the “true superstar” of the Pectra upgrade, as it effectively begins to erase one of Ethereum’s long-standing limitations: the strict divide between EOAs (basic accounts controlled by a private key) and contract accounts.

What it does: EIP-7702 introduces a new transaction type that lets an EOA set a snippet of smart contract code to be executed during that transaction. In practice, this is implemented by allowing an EOA to have a temporary code field for the duration of the transaction, which points to some target contract logic (sometimes called a “delegation designator”). When the transaction runs, instead of the EOA just blindly transferring ETH or calling a contract as usual, the Ethereum Virtual Machine will execute the specified code in the context of the EOA. That code could, for example, make multiple calls, perform checks, or even decide not to proceed unless certain conditions are met – essentially anything a smart contract could do, but now tied to a user’s regular address. After the transaction, the EOA’s code field is cleared (it doesn’t permanently become a contract on chain). From a protocol standpoint, this is a short-term account abstraction measure – it adds smart-account capabilities without needing a full redesign of accounts or new opcodes, by piggybacking on the transaction format.

Why it matters:Huge user experience improvements and new possibilities for wallets. With EIP-7702, wallets can do much more in one go, reducing the friction of using dApps. Some concrete examples of what this enables:

- Batching multiple actions into a single transaction. For instance, instead of having a user click “Approve token” then “Swap token” in two separate steps (with two transactions and two gas fees), the wallet could execute an approval followed by a swap within one atomic transaction. This not only saves gas on overhead, but also makes complex interactions one-click for the user, greatly simplifying DeFi and gaming UX.

- Sponsored (meta) transactions and flexible gas payments. An EOA can include logic to have someone else pay its gas, or pay in a different token. This means dApps or relayers can sponsor gas fees for users or allow fees to be taken in ERC-20 tokens, enabling gasless or ERC-20-paid transactions. Users could interact with Ethereum without holding ETH for gas, which has long been a UX hurdle.

- Custom authorization and security logic. Because the EOA can run arbitrary checks, you can implement things like multisig approval, daily spend limits, or social recovery at the wallet level. For example, a user’s EOA could require a second signature from a guardian contract for transfers above a certain amount, all enforced within the transaction’s execution. This opens the door to smart contract wallet features on EOAs, such as allowing a user to delegate transaction rights to another address with fine-grained control, or integrating WebAuthn/passkeys for transaction approval.

In essence, EIP-7702 blurs the line between regular accounts and smart contracts, addressing what many consider an original design flaw of Ethereum’s account mode. The community is excited: teams like Safe (Gnosis Safe) and Tenderly have written about the possibilities unlocked, from “smart accounts” with better custody to novel dev tooling for these new transaction types. By dramatically improving usability, this upgrade should make on-chain interactions smoother (fewer prompts and transactions for end-users), potentially increasing user retention in dApps. It also benefits developers by allowing more complex interaction patterns to be packaged into one transaction, simplifying dApp workflows. While full account abstraction (where EOAs might be phased out entirely in favor of smart accounts) is a larger roadmap goal, EIP-7702 is a meaningful first step towards that future. In summary, this EIP enhances Ethereum’s user-friendliness and composability by empowering wallets to do more with less hassle – a critical improvement as we aim to onboard the next billion users.

EIP-7702

EIP-7702EIP-7691: Blob Capacity Scaling (Double the Data for Rollups)

Turning to scalability, EIP-7691 delivers an immediate boost to Ethereum’s data availability throughput for layer-2 networks. This EIP increases the amount of “blob” data that can be included in each block, effectively doubling the space available for rollups that post data to Ethereum. Recall that in the previous Dencun upgrade, Ethereum introduced blobs (via EIP-4844 proto-danksharding) – large binary chunks of data stored off-chain (in the beacon nodes) but tied to blocks via commitments, mainly to make posting rollup transaction data cheaper. However, those blobs had initial limits on how many could fit in a block (a target of a few per block). EIP-7691 raises those limits.

What it changes: The target blobs per block increases from 3 to 6, and the maximum blobs per block from 6 to 9. In other words, under normal conditions Ethereum will aim for ~6 blobs in each block (up from 3) and can handle bursts up to 9 blobs in a single block (up from 6) if needed. This roughly doubles the average data throughput allocated to blobs. In terms of gas parameters, the blob gas target goes from ~393k to ~786k (double), and blob gas max from ~786k to ~1.18Mg – but the simplest view is: twice as many blobs can be included.

Why it matters:Better scalability and lower fees for L2s. Because rollups use blobs to dump their transaction data onto L1, increasing blob capacity means rollups can include more transactions per block or pay less in fees per transaction (since there’s more supply of data space). Ethereum’s rollup-centric roadmap relies on these periodic increases to keep up with demand. With EIP-7691, Layer-2 networks get a direct throughput boost, which should reduce the cost of posting data and thereby lower users’ L2 transaction fees. This upgrade is basically a scaling tune-up for the interim between now and full danksharding in the future.

Developers didn’t take this step lightly – initial blob limits were set conservatively in Dencun to ensure network stability. Since then, monitoring showed the network handling the blob load well, so a 2× increase was deemed safe. Pectra’s blob boost is considered a “most important component” of the upgrade for scaling, though it’s still a modest step. In fact, even larger blob expansions are being discussed for subsequent upgrades – Vitalik Buterin has floated targets like 48 blobs per block (an 8× jump) in the future. For now, EIP-7691’s doubling will provide immediate relief and capacity for growing L2 usage. It improves efficiency for rollups and pushes Ethereum closer to its long-term throughput goals, all while staying within safe operational limits verified by testing.

EIP-7742: Dynamic Adjustment of Blob Capacity (On-the-Fly Tuning)

Complementing the immediate blob count increase, EIP-7742 lays important groundwork for making Ethereum’s blob capacity adjustable and future-proof. Currently, parameters like the target and max blobs per block are hardcoded in the protocol (set by the fork’s code). EIP-7742 “uncouples” this by allowing the consensus layer to dynamically set blob targets and limits and inform the execution layer via the Engine API. In essence, it moves blob limit governance from static code to the chain’s configuration, so it can be tweaked more easily in future upgrades or even adjusted adaptively if needed.

What it entails: After this EIP, the execution layer (EL) will no longer have fixed blob limit values baked in; instead, it relies on the consensus layer (CL) to provide the current TARGET_BLOBS_PER_BLOCK and MAX_BLOBS_PER_BLOCK values at runtime. The CL will also handle checking that blocks don’t exceed the max blob count, which makes an extra EL-side check redundant and thus removed. This change doesn’t immediately alter the blob numbers by itself – rather, it changes how those numbers are set and enforced. Think of it as making blob capacity a configurable parameter that the CL can update (likely through fork changes or governance) without needing to do simultaneous changes in EL clients. It provides “more flexibility over the [blob target] value” instead of the rigid fixed ratio from EIP-4844. In combination with EIP-7691, it means Pectra’s upgrade will use the new mechanism to implement the 6/9 blob limits, and future upgrades could further raise (or even lower) those limits by updating the CL logic, with the EL automatically following suit.

Why it matters:Agility and future scalability. EIP-7742 is a bit abstract, but it paves the way for smoother upgrades to Ethereum’s data availability. With fixed limits in both layers, changing blob capacity in the future would require coordinated changes everywhere; by delegating this to the consensus layer, devs can now adjust blob targets without hard-forking the execution layer each time. This is especially crucial for the roadmap toward Proto-Danksharding and Danksharding (e.g. PeerDAS) – where blob counts may be scaled up significantly. As one Ethereum core dev explained, the current hardcoded mechanism is “difficult to change,” and EIP-7742 “introduces a mechanism to dynamically set” those parameters so that developers can easily adjust them in the future. In other words, Ethereum becomes more nimble in tuning its throughput to meet demand.

For layer-2 teams and the community, this is reassuring: it means if blobs start nearing capacity, the protocol can respond more quickly. In fact, this EIP was added after rollup developers expressed urgency to increase blob capacity sooner rather than later. Ethereum researchers like Christine Kim noted that the fixed blob count was already approaching its limit and could “impede scalability if not addressedm – EIP-7742 is the answer to that concern, ensuring the network isn’t stuck with inflexible limits. It’s worth noting that introducing this dynamic mechanism was non-trivial (it required coordination between EL and CL client teams and even caused minor delays to the upgrade timeline). But developers deemed it worthwhile, given that it reduces the rigidity of the system and future-proofs Ethereum’s scaling. In summary, while EIP-7742 might not have an immediately visible effect to users, it is a strategic upgrade that makes Ethereum’s data availability layer much more adaptable, directly supporting long-term scalability and the ease of implementing changes like those in EIP-7691 and beyond.

Ethereum

EthereumConclusion: A Holistic Leap Forward

The Pectra upgrade brings a suite of improvements that, together, make Ethereum more efficient, scalable, secure, and user-friendly. On the validator side, EIP-7251, 7002, and 6110 significantly upgrade the staking experience: higher-capacity validators will streamline operations and reduce network overhead, while new withdrawal and deposit mechanisms increase security and give stakers more control over their funds. For Ethereum users and wallet developers, EIP-7702 is a game-changer – finally enabling “smart accounts” that can handle complex tasks in one go and provide a smoother, safer UX. And on the scalability front, the blob-related EIPs (7691 and 7742) boost Layer-2 throughput today and set the stage for bigger data capacity jumps tomorrow, reinforcing Ethereum’s rollup-centric scaling vision.

Community sentiment around Pectra is largely positive, especially regarding the account abstraction milestone and the much-needed relief for L2s. Ethereum core devs and researchers have highlighted that while these changes are mostly “under the hood” (no flashy token economics changes or anything), they are critical investments into the network’s robustness and future growth. By addressing long-standing technical debts and enabling new functionality, Pectra continues Ethereum’s steady evolution post-Merge. Developers can look forward to simpler staking operations, more powerful wallet capabilities, and improved layer-2 performance – all of which ultimately benefit the end-user experience and Ethereum’s competitiveness as a blockchain platform.

In short, the Pectra upgrade exemplifies Ethereum’s ethos of iterative improvement. It tackles practical problems (from validator queue bottlenecks to clunky user workflows) with technical solutions that make the protocol more flexible and user-centric. As Pectra rolls out, Ethereum will become a more capable base layer: one that can securely handle an ever-growing validator set, seamlessly empower smart accounts, and efficiently support the data needs of the next generation of rollups. For Ethereum developers and power users, understanding these changes is key – not only to ensure readiness for the upgrade, but to start innovating on top of the new features and efficiencies unleashed. Ethereum’s roadmap is far from over, but Pectra is a major step forward in the journey toward a scalable, user-friendly, and resilient Ethereum network.

Sources:

EIP-7251: Increase MAX_EFFECTIVE_BALANCE

EIP-7002: Execution Layer Triggerable Exits/Withdrawals

EIP-6110: Supply validator deposits on chain

EIP-7702: Temporary Account Abstraction via Smart Contract Code

EIP-7691: Increase MAX_BLOBS_PER_BLOCK and TARGET_BLOBS_PER_BLOCK

EIP-7742: Dynamic blob count based on CL configuration

Coinbase Engineering – The Pectra Upgrade: What Ethereum Stakers Need to Know

QuickNode – Ethereum’s Pectra Upgrade Explained

Galaxy Research – Ethereum Staking Is Changing: The Impact of EIP-7251

Christine Kim on X (Ethereum core dev updates)

Safe – Smart Accounts and EIP-7702

Tenderly – What You Should Know About EIP-7702